Payment Agreement Template

A payment agreement, also known as a payment contract or installment agreement, is a document that defines all of the terms of a loan between a lender and a borrower. If you're lending money, use our free Payment Agreement PDF Template to create professional payment agreements for borrowers. Simply fill out this form with crucial loan data like payment schedule, payment method, amount due, and debtor and creditor information, and this Payment Agreement Template will store your payment contracts as secure PDFs that you can download, send to customers, and print for your records.

What is a Payment Agreement?

A payment agreement is basically a legal document that outlines the terms and conditions of a loan or a payment.

Payment agreement is a contract that involves two parties wherein one of the party has borrowed the money or purchased something on credit.

The payment agreement highlights the total amount of money that is owed, the arrangement to pay off the owed amount, warranties about the payment process and the penalty when there is a failure to abide by the agreement.

Usually in payment agreements, there is little to no interest rate included as long as the payments are made on time.

Setting up a payment agreement requires authorization of a debtor and creditor to explain the terms and conditions in the agreement.

Both the debtor and creditor should reconcile oneself with a payment arrangement that is beneficial to both parties.

Debtor and creditor must come to an understanding with payment agreement that benefit both parties simultaneously.

Payment agreements are helpful in ways that both parties that are involved know exactly what they are agreeing to before they sign anything.

Payment periods, Number of payments and interest rate (if any) are three of the most important parts of a payment agreement.

You could use Awesome Sign's easy to use electronic signature to easily edit pdf template.

Main Components of a Payment Agreement

A payment agreement consists of different sections, following are some of the major sections that are included in a payment agreement:

- Creditor’s name and address

- Debtor’s name and address

- Acknowledgement of amount owed

- Amount owed

- Payment period

- Payment instructions

- Late payment (if any)

- Interest rate (if any)

- Other agreements

- The state of governing law

After both creditor and debtor have signed the payment agreement, the agreement becomes legally valid.

Any payment agreement that consists of a large amount of money should have Notary Acknowledgement attached.

In case of a Notary agreement, the notary authenticates the document and identities of both parties and validates the agreement by signing it.

Both must be present in front of the notary for this process.

When the payment owed has been paid-in full the debtor will be released from any sort of financial liability.

This process can be completed through a ‘Release Form’ between the two parties involved.

When is a Payment Agreement needed?

A payment agreement is required when the parties are planning to lend or borrow money.

It is also required when parties are making an amortization table or when they want to determine the number of payments and interest that will need to be made on the loan.

There is lot of information that is usually required while writing a payment agreement specifically with loan, but it can be simplified if one keeps the important data and details organized.

Writing a simple payment agreement

Whether you are debtor or creditor of money, writing a payment agreement is essential and in your best interest.

Drafting process of payment agreement will also help you in negotiating important points with the other party involved.

Following are the points that are a definite part of a payment agreement:

- Exact due date of payment

- The date when the agreement was signed and came into effect

- Date of first payment

- Date when each payment will be made in the coming days

- A grace period (if there is any)

- A date when the payment is considered late

- The amount that will be charged if any payment is late

- At what point the late payment is considered to be a default in the loan

It is important to include these aspects in payment agreement and have both parties come to an understanding regarding these points.

Importance of a Payment Agreement

Payment agreement work as a receipt that includes all the details of the payment.

Failure to follow the terms of the agreement could be held in breach of contract.

Having a payment agreement in writing is important for both creditor and debtor and it will help both parties by ensuring that they are on the same page about everything.

A contract for payments is important because it clarifies how much will be given or received, and when, is essential for accurate cash flow projections.

Types of Payment agreement

Payment agreement have different types and they have their own set of rules with advantages and disadvantages. Following are the different kinds of payment agreement:

1. Deferred Payment Agreements

It is an arrangement or loan with local authority that is secured against your home at fixed rate of interest.

The loan is made to be repaid after a person dies or their home is sold. The criteria to take out the deferred amount is as follows:

- The value of a person’s asset excluding their home must be less than upper means test threshold

- The person must be living in a care home

Basically, a deferred payment agreement is a legally binding agreement.

This agreement allows the party to defer or delay paying some of the amount until a later date.

However, the amount that is deferred should be paid in full in the future.

A deferred payment agreement can be helpful for a person if they have been assessed to pay the full amount of their residential care, but they cannot afford to pay at the moment hence they sign this payment agreement to defer or delay the amount.

Advantages:

A deferred payment agreement can be very beneficial if the person is not ready to sell their home or they are finding it difficult to sell their property.

It is also beneficial in case you want a cost-effective bridging loan so that you can sell your property in future when the prices have increased.

The agreement can be combined with renting out your home which can help with keeping the loan cost low.

Since the property has not been sold yet, the owner will continue to receive the benefits like ‘Attendance Allowance, Personal Independent Payment, and Disability Living Allowance’.

Disadvantages:

Deferred payment agreement is most likely to reduce the amount of inheritance that you will leave behind.

With signing a deferred agreement, you will have to carry on paying maintenance costs and insurance for your home.

It can be difficult to get insurance cost for your property if no one is living there for the time being.

Another disadvantage of deferred agreement is that if the prices fall then, you may find yourself with less money to pay for care fees.

The deferred payment piles up as a debt which is cleared once the money tied up in the property owned has been released.

The debt, however, can also be cleared from other resources (if any).

Common Sections of Deferred Payment Agreement:

- Agreement and Acknowledgment

- Vesting

- Limited partnership agreement

- Governing Law

- Dispute Resolution

- Entire Agreement

- Definition

- Termination and Modification

- No Assignment

2. Extended Payment Agreement

Extended payment agreement is basically a strategy that is used by buyers that leverages paying invoices over longer than normal period (which can increase to 120 days or more).

Extended payment only benefits the buyers and it very risky for sellers as it put them in a dangerous position.

With extended payment the sellers only have two choices; either they should accept the terms and figure out how to close up on their cash flows or they can push back and damage the deal they have worked hard to close.

Signing an extended payment agreement with supplier is an impressive way to increase your working capital.

For organizations that are more efficient and have more cash in hand, the capital that is generated from this agreement can be allotted to priority projects quickly.

Companies that are looking to grow can use this increased working capital into expanding operations.

Lastly, with the help of extended payment agreement, the organization has increased its working capital and the cash in hand frees the organization to buy back stocks and an increased capital will keep the investors satisfied as well.

Benefits of Extended Agreements:

One of the main and most valuable benefit of extended agreement is that it can help you free up more of your working capital.

This helps you by giving your business more time to pay off your suppliers and creditors, you will be able to allocate the increased working capital towards achieving other goals of the organizations which can be anything including paying off large suppliers with stricter payment terms or by using cash for other expenses.

Extended agreements will help you unlock a significant source of cash after extending the agreement with your supplier all while keeping the same payment terms for your account receivable.

However, while you are signing an extended payment agreements there are some setbacks as well.

Since an extended agreement is not as beneficial for suppliers and it might send the suppliers into a financial dilemma, the organization is most likely to experience a pushback from its suppliers.

In simple words when a company signs an extended agreement with its suppliers, it unveils more available cash.

The company is required to carefully allocate the resources in the wisest way possible.

As soon as the working capital is increased the question arise ‘Where can the capital best allocated?’ it is a critical and important time for companies to gather their decision makers and take a thorough look at their organization and come to the right decision at the end.

3. Business Payment Agreement

When someone is starting a business no matter how big or small, making an agreement involving the business transactions is important.

Business involves a wide range of large and small transactions, some of these transactions may be part of an ongoing transaction, such as Investment Contract Templates, it can be used by the stockholders to work out payment contracts for daily transactions related to business.

Payment agreement related to business will include clauses that include details about how business will transactions, whether electronically or through COD.

It also includes points such as what will happen if the buyer cancels a transaction.

These points can help reduce the risk of a non-payment, it can provide protection against chargebacks and can also give the owner leverage over their intellectual property rights by restricting access to content until after the customer has paid.

By having a business payment agreement, you will protect your business and avoid disputes that could arise from lack of clarity around these issues.

4. Installment Payment Agreement

Installment Payment is used if the payment agreement that you are signing is based on installments.

An installment agreement can help you in numbering the payments and in determining the amounts and interests that will need to be made on an agreed payment schedule.

5. Personal Payment Agreement

A personal contract or personal agreement is usually used when handling small transactions with fewer specifications and is mainly related to direct payments.

Use Awesome Sign to get started, and sign your pdf documents effortlessly.

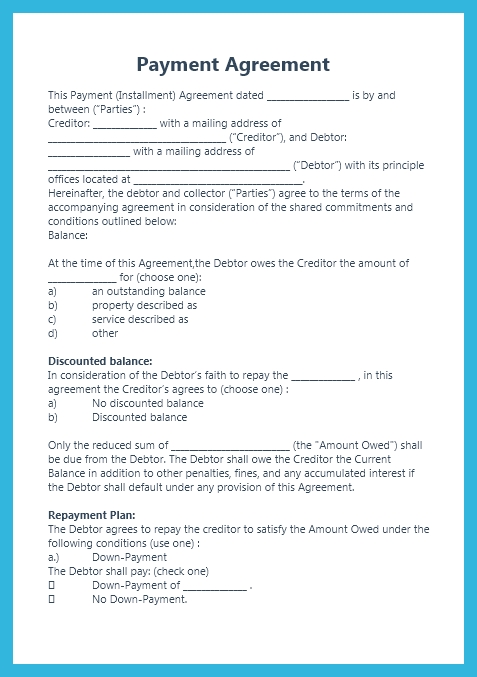

Template Preview

Payment Agreement

This Payment (Installment) Agreement dated __________________ is by and between (“Parties”):

Creditor: ______________ with a mailing address of

_______________________________________ (“Creditor”), and Debtor: __________________

with a mailing address of _____________________________________________________

(“Debtor”) with its principle offices located at _____________________________________.

Hereinafter, the debtor and collector (“Parties”) agree to the terms of the accompanying agreement in consideration of the shared commitments and conditions outlined below:

Balance:

At the time of this Agreement,the Debtor owes the Creditor the amount of _______________ for (choose one):

a) an outstanding balance

b) property described as

c) service described as

d) other

Discounted balance:

In consideration of the Debtor’s faith to repay the ______________ , in this agreement the Creditor’s agrees to (choose one) :

a) No discounted balance

b) Discounted balance

Only the reduced sum of __________________________ (the "Amount Owed") shall be due from the Debtor.

The Debtor shall owe the Creditor the Current Balance in addition to other penalties, fines, and any accumulated interest if the Debtor shall default under any provision of this Agreement.

Repayment Plan:

The Debtor agrees to repay the creditor to satisfy the Amount Owed under the following conditions (use one) :

a.) Down-Payment

The Debtor shall pay: (check one)

$\checkmark$ Down-Payment of ______________ .

$\checkmark$ No Down-Payment.

b) Interest Rate. The Amount Owed shall: (check one)

$\checkmark$ bear interest at a rate of _______________ percent (____%) compounded

annually. The rate must be equal to or less than the usury rate in the State of the Borrower.

$\checkmark$ not bear interest.

Repayment Period:

The Debtor shall re-pay the Creditor on a: (check one)

$\checkmark$ Weekly basis beginning on __________________ in the amount of _______________ to

be paid every seven (7) days ending on _________________ or when the Amount Owed

is paid-in-full.

$\checkmark$ Bi-Weekly basis beginning on _________________ in the amount of $$ _________ to be

paid every fourteen (14) days ending on ________________or when the Amount Owed

is paid-in-full.

$\checkmark$ Monthly basis beginning on _________________ in the amount of _____________ to be

paid on the 1st of every month ending on _________________ or when the Amount

Owed is paid-in-full.

$\checkmark$ Any Other: _______________________________________________________.

Payment Instructions:

The instructions for the Debtor's payment to the Creditor are as follows:

$\checkmark$ Direct payments from the Debtor to the Creditor's bank account must be made.

$\checkmark$ Other

Payment Method:

Payment shall preferably be made to the Creditor in accordance to the mode decided in the agreement, but in other cases the Debtor may choose his method of payment according to convenience.

Late Payment:

Any partial or late payment under this Agreement shall: (check one)

$\checkmark$ Not be allowed and consider the Debtor in default.

$\checkmark$ Allow the Debtor to make payment within _____ days provided the Debtor pays a late fee

of: __________________________ (“Extension Period”). If payment is not made within

the Extension Period, this Agreement shall be in default.

Acceleration Clause:

In the occurrence that the Debtor fails to render payment within 15 days of the scheduled payment plan, the full amount of deficiency shall become due and demandable.

Any further failure shall gives the right to the Creditor for the demand of damages.

Prepayment:

The Debtor may: (check one)

$\checkmark$ Pre-pay the Amount Owed without penalty.

$\checkmark$ Not prepay the Amount Owed. If the Debtor decides to prepay the Amount Owed, the Debtor shall pay the penalty of: _______________________________.

Default:

The Debtor shall be deemed in default if, for any reason, they fail to comply with any provision or portion of this Agreement.

In this situation, the debtor will be responsible for paying the entire remaining balance of the amount owed within five (5) business days.

Debtor shall pay:

$\checkmark$ Reasonable attorney fees, legal charges, and the Creditor's collection expenses.

Additionally, the Creditor could

$\checkmark$ reclaim any items or property connected to the amount owed, keep them, and dispose of

them.

$\checkmark$ and, subject to the debtor's permission, gather costs as well as any shortfall owed from

the debtor’s legal right to return the goods pursuant to law.

Severability:

If any provision found in this agreement is held illegal, invalid, or unenforceable by any competent court, the same will apply only to the provision and the rest of provisions shall remain valid and unenforceable.

Agreement Modification:

No modification of the agreement shall be considered until found in written and agreed by both Parties.

Governing Law:

This Agreement shall be governed by and construed following, the laws of the State of ______________________________ (“Governing Law”).

Additional Terms and Conditions:

$\checkmark$ If any __________________________________________.

$\checkmark$ N/A

Complete Agreement:

This Agreement, including any attachments or addendums, is the entire agreement between the Debtor and the Creditor concerning its subject matter.

All prior negotiations, understandings, and oral agreements are superseded by this Agreement.

The Parties have signed this agreement in witness whereof on the dates listed beneath:

Debtor: ____________________________

Date: ______________________

Collector: ___________________________

Date: ______________________