Loan Agreement Template

When you borrow money from a friend or family member, it's important to have a loan agreement in place to protect both parties. This guide will help you check it!

Loan Agreement

Loan agreements are serious documents that assist in shielding and safeguarding the money of both the parties involved. Mostly, a lender generates a loan agreement before extending a sum, which means the lender gets to decide the terms and other conditions that are to be mentioned in the agreement.

One must thoroughly understand all the aspects of creating a loan agreement before getting started with one. This vital document protects you long-term and can assure a good payback.

The article comprises all details you necessitate for creating valuable loan agreements. Make a solid document with the assistance of this guide and make the most benefits.

What exactly is a loan contract?

A loan is when one person or business entity (the lender) lends money to another person or business entity (the borrower) for an agreed-upon sum in exchange for repayments plus interest. A loan contract is a legally binding agreement between lenders and borrowers that details the loan's terms and conditions, such as the principal amount, payment schedule, security checks, interest rate, and length. Loan agreements are necessary in order to hold lenders and borrowers accountable for what they agreed to. Without a contract, the possibility of a deal going wrong rises. A lender, for example, may charge a borrower more interest than was agreed upon.

You could use Awesome Sign's easy to use electronic signature to easily edit pdf template.

What is the Necessity of a Loan Agreement?

Before lending money or extending services without being paid, it is crucial to identify if you necessitate a loan agreement to shield you from unnecessary chaos. One must avoid loaning any goods, money, materials, or services without creating a loan agreement and getting signatures on the same. In most cases, loans that do not have any documentation proof are considered invalid and cannot seek legal assistance in case of breaches. The chief aim of creating a loan agreement is to mention all the details of the article being loaned. Further, the document also comprises the due date and how and when the individual will return the article with interest.

Every loan agreement comprises specific terms that mention details of the expectations and the return terms. After it is properly executed, the borrower needs to pay back in the dated time. Borrowing any amount of money is an important process, irrespective of the amount. Thus, it is vital to protect both parties with a bond to ensure complete safety. The agreement mentions the loan specifications and specifies that the sum extended is not a gift. Doing so enables more security as the borrower cannot make false claims like this to avoid repayment. Further, it also ensures that no issues occur with the IRS later.

Most individuals make common mistakes by lending money to close pals and families without making a loan agreement. However, it is not a fine idea. Any load extended without an agreement is susceptible to issues and disputes that one cannot solve legally.

So, if you think about whether you should or should not opt for a loan agreement, we suggest it is always profitable to be safe and draft a suitable one. If you are lending a huge amount of money, then creating a loan agreement with the consent of both parties is even more important. Also, take additional steps to ensure that you have drafted a legally safe and sound copy to prevent losses. A loan agreement is structured to guard you and dismiss risks. Thus, make a loan agreement and ensure you protect yourself at all costs.

There are varied elements of this agreement that you will necessitate to draft an ideal copy for your work. Some critical components are detailed further in the guide. Take assistance and make the most profitable loan agreement to safeguard your cash completely. Read on and discover more valuable insights about loan agreements and their working.

How to Draft a Loan Agreement?

Drafting a loan agreement is quite simple. Certain standard steps that will assist you in making a suitable copy are:

Introduction The first essentials of a loan agreement are listing a few important aspects. Mention the date, heading, and the type of loan you are extending or applying for before proceeding.

Mention Terms Every legal document should list a few terms to make the copy more authentic and legally safe. Listing the more critical terms in your loan agreement is highly necessary. The chief add-on aspects are personal payment methods, conditions of repayment, and interest percentage. Apart from these, other specifications, if you should also list any for best security.

Date Noting the date of the document’s enforcement is also needed. So, mention the date on the document and in the contract to estimate repayment accordingly. Most repayment procedures depend on the date the loan is issued. Thus, noting the date is a key component that one must not miss.

Statement of Agreement All loan contracts must include this important element in them. These statements are similar to, “The lender and borrower agree to the terms listed above.” Doing so ensures that both the lender and borrower agree to the terms and better understand them.

Sign the Document Both the parties must sign the document to proceed with the contract finalization. Signs make the document legally enforceable and suitable for use.

Record the Contract Recording the document at the recorder’s office is also necessary. Doing so will shield the loan if any of the parties misplaces or loses their paperwork. You can create a loan agreement without much hassle using these simple steps. They are applicable for all cases and can be used to safeguard your bonds against disputes completely.

Loan agreements are a must before lending any amount. These documents give you better legal assurance and safeguard the money you lend in all possible ways. Creating a loan agreement that comprises all the vital legal details is also necessary. Thus, please list all the specific terms, dates, and signatures in your contract to make it legally bound and suitable for your work. The aspects listed above will assist you in making a reliable copy. So, use them and build a solid loan agreement today.

Use Awesome Sign to get started, and sign your pdf documents effortlessly.

Template Preview

Loan Agreement Template

Prepared for:

[Borrower]

[Borrower Company]

Created by:

[Lender Name

[Lender Company]

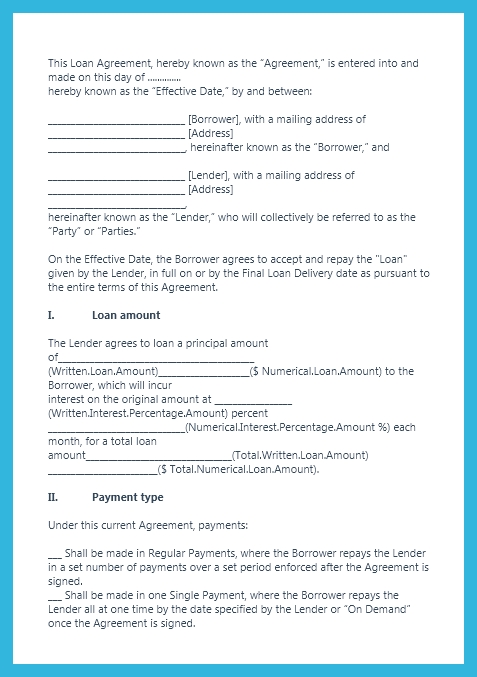

This Loan Agreement, hereby known as the “Agreement,” is entered into and made on this day of ....................... hereby known as the “Effective Date,” by and between:

______________________________ [Borrower], with a mailing address of

______________________________ [Address]

______________________________, hereinafter known as the “Borrower,” and

______________________________ [Lender], with a mailing address of

______________________________ [Address]

______________________________

,hereinafter known as the “Lender,” who will collectively be referred to as the “Party” or “Parties.”

On the Effective Date, the Borrower agrees to accept and repay the "Loan" given by the Lender, in full on or by the Final Loan Delivery date as pursuant to the entire terms of this Agreement.

I. Loan amount

The Lender agrees to loan a principal amount of ___________________________________________ (Written.Loan.Amount) ____________________ ($$ Numerical.Loan.Amount) to the Borrower, which will incur interest on the original amount at _________________ (Written.Interest.Percentage.Amount) percent ______________________________ (Numerical.Interest.Percentage.Amount %) each month, for a total loan amount________________________________(Total.Written.Loan.Amount) ________________________($ Total.Numerical.Loan.Amount).

II. Payment type

Under this current Agreement, payments:

____ Shall be made in Regular Payments, where the Borrower repays the Lender in a set number of payments over a set period enforced after the Agreement is signed.

____ Shall be made in one Single Payment, where the Borrower repays the Lender all at one time by the date

specified by the Lender or “On Demand” once the Agreement is signed.

If “Regular Payments” is selected, the Borrower will make (Daily/Monthly/Yearly) payments of $.............. (Numerical.Payment.Amount) beginning on the ...../...../.........(Effective.Date/MM/DD/YYYY) and to be paid every ................ (Day.Of.Week) until the loan amount is paid, ending on ...../...../....... (Date) hereby known as “Term.”

If “Single Payment” is selected, the Borrower will make a lump sum payment of $ ................ (Numerical.Payment.Amount) paid on ....../...../........... (Effective.Date/MM/DD/YYYY) hereby known as “Term.”

III. Late payments

Payment shall be considered late if not made by ........... (Time.In.AM.or.PM), (Time.Zone) on the ..................(Day) calendar day of each month. All late payments are subjected to a late fee of $ .............. (Numerical.Interest.Amount) OR (Numerical.Percentage.Amount) %. Late payments can be made in the same payment method as outlined in Section IV.

IV. Accepted payments forms

The following methods are acceptable (Check all the apply):

____ Cash ____ Money Order ____ Personal Check Cashier’s Check ____ Debit Card Credit Card ____ Wire Transfer ____ Other: (State.Other.Payment.Methods)

V. Prepayment

The Borrower (Will/Will.Not) be penalized for making payments in advance.

If allowed, the Borrower (Is/Isn't) required to provide (Insert “(Days) of” if they require notice) written notice. ...................(Insert “A discount will be given to the Borrower of $ (Dollar.Amount) or .......... (Percentage.Amount) % if the full loan amount is paid by ........./......./.......... ” if applicable.)

VI. Collateral

The Borrower shall use (Item.Used.For.Collateral (Examples: Mortgage, Real Estate Property, Inventory)) if they default on their secured Loan to repay the Lender.

VII. Non-payment penalties (acceleration)

In the event that the Borrower doesn’t pay their Loan by the end of the Term or fails to make regular payments, Acceleration will occur. Upon Acceleration under this Agreement, the Lender shall have the right to declare the Loan balance immediately due and payable. Should the Borrower refuse, the Lender may seek legal action.

VIII. Legal fees

In the event that Acceleration occurs, the Borrower agrees to pay reasonable attorneys’ fees not exceeding a sum equal to the maximum usury rate in the State of [Borrower.State], of the then outstanding balance owing on the Loan as outlined by this Agreement, plus reasonable expenses made by the Lender as they exercise their rights and due remedies in court.

IX. Disputes

Both Parties may seek damages by:

____ Court Litigation ____ Arbitration Mediation ____ Mediation, then Arbitration

X. Severability

In the event any provision in this Agreement is held to be unenforceable, illegal, or invalid, it shall not affect the enforceability, legality, or validity of other provisions.

XI. Waiver of parties

The exercise of any power or right under this Agreement may be exercised at the discretion of the Party to which the benefit of that power or right occurs. Delaying or failure to exercise these rights or remedies does not prevent its exercise nor partial exercise to preserve further exercise of that power or right.

XII. Governing law

This Agreement follows the governing laws of the State of [Borrower.State].

XIII. Notices

All notices or communication under this agreement must be delivered:

____ In-Person

____ Through Overnight Courier Service

____ By Certified or Registered Mail

____ By Email

____ By Text Message As a Copy

____ Other (State.Other.Notice.Methods)

XIV: Successors

This Agreement will be binding on and inure to the benefit of the permitted assigns and respective

successors of both the Lender and Borrower.

XV. Execution

IN WITNESS WHEREOF, the Parties agree that this Agreement will come into effect on ...../...../..........

LENDER: BORROWER:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

[Signature]

By: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

[Signature]

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _

[Signature]