Indemnification Agreement Template

An indemnity agreement is a document that affirms that someone is to be held harmless from liability in a particular situation. Protect yourself and your business.

Indemnification Agreement

Indemnity documents are a must to affirm that individuals are held completely harmless from liabilities in specific situations. Drafting these important bonds assures more safety and lesser transactional risks. It safeguards the indemnified individual against any losses and damages linked with the business setting. For additional insights about an Indemnification Agreement, read to the end. The article covers all details and offers a brief view.

Indemnification Agreement: What Is It?

When two or more parties agree, it's not uncommon for one or more of those parties to want some sort of assurance that they will not be held liable for any damages or losses that the other party may incur. This is where indemnification comes in. Indemnification is a clause in an agreement that offers protection to one or more parties involved from any potential liabilities that may arise from the agreement. In other words, it ensures that the party will not be held responsible for any losses or damages that the other party may cause.

You could use Awesome Sign's easy to use electronic signature to easily edit pdf template.

This bond is a contract that safeguards one party of a business from the losses or risks formed by another business party involved. There are also other terms that help in knowing this document well.

For example, rental companies demand the renter to agree upon an indemnity bond to ensure that the company is not held accountable for any loss or damage while the car is in use. It means if any accident occurs while the car is in use, the company renting the vehicle will not be responsible for paying any damage costs.

An indemnity bond will shield the party against cases, damages, or false claims from third parties. An Indemnification Agreement operates in the following ways:

Shield the indemnified party against any laws or cases by the third partiesShield the third party from false claims made by the indemnified party

What is the Necessity of an Indemnification Agreement?

Indemnification is essential because it protects the parties involved in an agreement from any potential liabilities that may arise. This can be especially helpful in situations involving many risks, or one party may be held liable for damages they did not cause. By having an indemnification agreement in place, both parties can feel confident that they are protected in the event of any problems.

The chief aim of drafting these bonds is to safeguard a party from being accountable for any losses or contracting party’s negligence. Always get your draft examined by a financial advisor or lawyer to identify if your Indemnification Agreement is suitable for use.

Perks of using indemnity bonds are:

No need to prove the cause or happeningSafeguards against all losses and extra expensesContract breaches are supported by clauses

In other words, one must consider drafting an indemnity bond while dealing with third parties in your business. Incorporating these laws in master service bonds is also possible. Further, it works as a standalone document for all your necessities. Irrespective of the method you opt for, it is vital to familiarize yourself with all the key terms mentioned in the Indemnification Agreement.

If you're considering agreeing with another party, it's essential to understand indemnification and make sure that you have an indemnification agreement in place. This will help protect you from any potential losses or damages due to the deal. Contact a business and commercial lawyer if you have any questions about indemnification agreements.

Types of Indemnification Bonds

These agreements are categorized depending on the level of protection that they extend to the indemnified party.

Broad form

Under this bond category, a party is assured against liability even if they are the chief cause of the liability. This indemnity bond is quite rare in most states, particularly for construction contracts.

Intermediate form

This type of Indemnification Agreement assures that the party is not responsible or at fault in case of negligence, so here, the Indemnitor still safeguards a somewhat negligent indemnitee. These kinds of contracts are labeled under “caused in part.”

Comparative form

In this kind of Indemnification Agreement, both or all involved parties are liable for the acts caused due to any negligence. Every party confirms to hold the other party harmless for any action caused by mistake. Look for “only to the extent” to spot these types of indemnification bonds.

Components of an indemnity agreement

As we know, familiarising with the keywords is necessary for drafting a suitable Indemnification Agreement. Thus, include these keywords in your bond to make it suitable for use:

Jurisdiction and Governing Law The laws can differ according to region. Certain states acquire an anti-indemnity statute, while others do not. One must consider all these aspects while listing the state law that governs the bond and its rules.

An indemnity agreement might also list that the courts will have the right to settle any dispute that might arise during the agreement duration.

Indemnification clause This clause is the core part of your bond. Here you list the acts that an indemnitee will be assured against. You must ensure that the words are unmistakable, particularly if this agreement safeguards your firm. Doing so is vital as any doubt is usually settled in favor of the indemnitor.

The standard structure of this draft includes that the indemnitor approves to assure, defend, and hold not accountable” the indemnitee. It’s vital to include such phrases in the bond to assure better outcomes.

Scope The indemnity bond must mention the level of protection the indemnitee can demand under the contract. Before agreeing to or signing the indemnity bond, one must know that they are taking on obligations caused by your firm’s actions.

Indemnification exclusions In this section, the bond specifies the conditions under which the indemnitor does not safeguard an indemnitee. The terms can alter depending on the terms listed in the agreement. One must know where and how the indemnitee shall not be indemnified:

- Committing criminal offenses, unless the act was unlawful and is supported by plenty of reasons

- Unreasonable or Poor behavior

- Profited from the act

- Acquired or will acquire compensation under up-to-date policies, indemnity bonds, or similar documents.

Defense and Notice of a claim The bond should mention how an indemnitee will give the third party a notice that is mentioned in the indemnity bond. It should also list the guidelines of how the indemnitor can support their claim.

Consent Clause This section covers how the parties can acquire one another’s consent before getting into an argument or a claim listed in the bond.

Enforcement The bond should also offer that an indemnitee can impose the bond if the indemnitor does not agree to meet their obligations.

Duration Listing the valid time in the bond is also necessary. Doing so assists in offering a clear view of the agreement and its commencement date.

The Indemnification Agreement is a vital document that helps in safeguarding your company in all ways. Use this effective bond to secure your transactions and make beneficial business. Draft a suitable document as per the guidelines and reduce all third-party risks today.

Use Awesome Sign to get started, and sign your pdf documents effortlessly.

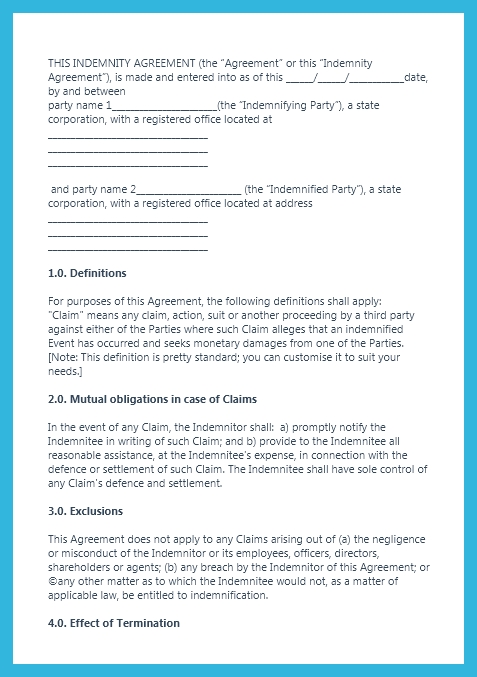

Template Preview

Indemnity Agreement

Template

Prepared for:

[Party 2]

[Party 2 Company]

Created by:

[Party 1]

[Party 1 Company]

THIS INDEMNITY AGREEMENT (the “Agreement” or this “Indemnity Agreement”), is made and entered into as of this ______ /______ /____________ date, by and between

party name 1_______________________(the “Indemnifying Party”), a state corporation, with a registered office located at

___________________________________

___________________________________

___________________________________

and party name 2_______________________ (the “Indemnified Party”), a state corporation, with a

registered office located at address

___________________________________

___________________________________

___________________________________

1.0. Definitions

For purposes of this Agreement, the following definitions shall apply:

"Claim" means any claim, action, suit or another proceeding by a third party against either of the Parties where such Claim alleges that an indemnified Event has occurred and seeks monetary damages from one of the Parties. [Note: This definition is pretty standard; you can customise it to suit your needs.]

2.0. Mutual obligations in case of Claims

In the event of any Claim, the Indemnitor shall:

a) promptly notify the Indemnitee in writing of such Claim; and

b) provide to the Indemnitee all reasonable assistance, at the Indemnitee's expense, in connection with the defence or settlement of such Claim. The Indemnitee shall have sole control of any Claim's defence and settlement.

3.0. Exclusions

This Agreement does not apply to any Claims arising out of (a) the negligence or misconduct of the Indemnitor or its employees, officers, directors, shareholders or agents; (b) any breach by the Indemnitor of this Agreement; or ©any other matter as to which the Indemnitee would not, as a matter of applicable law, be entitled to indemnification.

4.0. Effect of Termination

This Agreement will continue regardless of whether either Party terminates the Agreement for any reason whatsoever. If either Party terminates this Agreement, all Claims made or could have been brought before termination shall survive until fully resolved, settled, or finally determined according to their terms.

5.0 Miscellaneous Provisions

All notices required under this Agreement shall be given in writing and delivered by personal delivery or registered mail (postage prepaid) at the address listed on Exhibit A attached hereto or at such other address as may hereafter be furnished in writing by either Party to the other.

This Agreement constitutes the entire agreement between the Parties concerning indemnification and supersedes all prior negotiations, arrangements or understandings (whether written or oral) between the Parties concerning it. No modification of or amendment to this Agreement shall be binding unless in writing and signed by an authorised representative of both Parties.

Suppose any provision of this Agreement is held invalid, illegal or unenforceable by a court of competent jurisdiction. In that case, such provision shall be modified to the extent necessary to render it valid, legal and enforceable while as closely as possible reflecting the intent of the parties expressed in this Agreement. All remaining provisions of this Agreement shall continue in full force and effect.

This Agreement shall be governed by and construed by the laws of the State of ____________.

Signature of the Parties

By: _________________________

Name of Indemnitee

Title of Authorized Signatory for Indemnitor

Date: _____________

Signature of the Parties

By: _________________________ Name of Indemnitee Title of Authorized Signatory for Indemnitor Date: ______________ Solely as an example, your organization's indemnification agreement may look something like this. Please note that you should always have a qualified business and commercial lawyer draft or review any legal documentation that affects your business.