Accounting Contract Template

An accounting contract template is a document that can be used to help ensure that a business transaction between two parties is carried out in an orderly and fair manner.

What is an Accounting Contract?

Accounting Contracts are frequently used by accountants and their clients to specify the nature and conditions of the job to be done. This crucial document, which must be signed by both the customer and the accountant, can assist both parties in establishing expectations and lowering the likelihood of disputes.

Contracts are, at their most basic level, a mechanism that encourages greater corporate agreement. Contracts are particularly effective at preventing future conflict and disagreements because they are a set of terms that both parties have agreed upon.

You could use Awesome Sign's easy to use electronic signature to easily edit pdf template.

What purpose does a contract have in accounting?

Contracts are crucial in business because they define the expectations of both parties, provide protection for both parties in the event that those expectations are not satisfied, and fix the cost of the services that will be provided.

Various Accounting Contract Types

Fixed-Price Contracts

An agreement between a vendor or seller and a customer that specifies the goods and/or services that will be given and the amount that will be paid for them is known as a fixed-price contract, sometimes known as a lump sum contract.

Many individuals view the ability to know the project's total cost up front with fixed-price contracts as a major advantage. Buyer risk is low with fixed price agreements. The majority of the risk is assumed by the seller since customers frequently only pay for work once it is finished, even though buyers occasionally make a lump sum payment at the beginning of the project.

Cost-Plus Contracts

In a cost-plus contract, the contractor is compensated for all of their costs as well as an additional sum to cover profits. Cost plus refers to expenses over and beyond those incurred to complete the contract.

With a cost-plus agreement, neither the reduced material costs nor the amount of time required to finish the project are fixed. Costs may therefore change over the course of the project. In addition, customers are unaware of the project's total cost before it starts. The actual work and materials required for the project are frequently difficult to track as well. Many consumers like this choice despite the unknowns and risks involved. They only pay for what they really receive, which many customers consider to be advantageous.

Time and Materials Contracts

With a time and materials contract, a contract will outline the general scope of the job and include a proposal for a fixed hourly wage plus the cost of materials rather than providing a fixed fee for the complete project. As a guarantee to safeguard the client from escalating expenses, the contractor may also add a maximum price for the project, sometimes known as a "not-to-exceed" clause.

For buyers on a tight budget, time and materials contracts are ideal. This kind of contract offers a great approach for buyers to improve the capabilities of their team, provided they keep a tight check on the project costs. A time and materials project, however, runs the risk of going over budget if it is not well managed.

Is entering into a contract a liability?

A signed contract legally binds both the business and its owners to the terms of the contract agreement, unlike with a limited liability company or corporation. As a result, you and your company are each responsible for any debts and potential legal claims.

Is a contract considered an asset in accounting?

The right of an entity to receive payment in exchange for products or services it has provided to a customer when that right is subject to conditions other than the passage of time, including the entity's performance in the future.

What information should be included in an accountant contract?

To be covered in detail are:

Client's name and address

How much you'll reimburse

Whether the project will be continuing or only last a certain amount of time

What duties you will have after being recruited (for example, preparation of journals and ledgers, financial statements, or tax returns)

Your Accounting Contract template will also include the typical language regarding the non-employer relationship between the accountant and client, the protection of proprietary information, the method(s) of dispute resolution, and liability for losses, as you would probably expect from an agreement of this nature. You will be able to select the state whose jurisdiction your agreement is subject as to you write it.

The Benefits of Accounting Agreement

The question is whether or not to perform the contract. Or at least, if the talks I've had with customers, prospects, and colleagues are any indication, that's the question a lot of accounting and financial professionals in countries, are asking themselves these days. It's common knowledge that many businesses are turning more and more to contractors for their employment requirements in order to cut costs and maintain personnel flexibility. Contracting has been a tried-and-true method for employers wishing to strengthen their finance departments with certified, knowledgeable, and experienced accountants – the kind of people who can jump in and help right away amid a crisis, a busy period, or a significant project.

A series of contract jobs will give you plenty of opportunity to meet different people in a short amount of time, in contrast to full-time jobs where the faces you encounter will primarily be the same familiar ones. A six-month contract can give you face time with the CFO, the head of HR, the controller, and other hiring authorities inside a company in addition to the people you'll be working with or reporting to. You might meet as many important decision-makers on a few different contract tasks in two years as most individuals would in a full-time role in more than twice that amount of time.

Accounting Contract work might aid in your skill development and acquisition.

You must establish yourself in a role or area of expertise for the majority of full-time jobs. Being able to take on tasks in a variety of accounting duties, from internal auditing to forecasting and financial reporting, is one of the benefits of working as a contractor. This will enable you, among other things, to expand and broaden your skill set and prevent you from becoming pigeonholed into one particular expertise. If and when you decide to hunt for a permanent position, having worked at multiple firms where you had to use a variety of tools, equipment, software, and systems as well as in a variety of functional areas can offer you an advantage over other, less well qualified individuals.

Accounting Contract job can be quite lucrative.

As opposed to working as a regular employee, you can earn a good living as a contractor. On the one hand, businesses are not typically required to provide benefits to contractors, including as health and dental insurance, paid time off for vacation and illness. However, as a trade-off, companies can pay their contractors at rates that are often higher than the average wage for most salaried employees; many accounting contractors make far more per hour than their full-time counterparts. Additionally, as contractors typically bill by the hour, they are paid for every minute they are on the work.

- Accounting understanding language on data secrecy is also included in the sample, and it essentially covers the entire purpose of the contract.

- A limitation of liability clause protects both parties' interests in a particular circumstance and under predetermined conditions.

- When long-term contracts require the establishment of more precise expectations

Strategies for developing and maintaining accounting contract healthy.

Share relevant details with the accountant.

If your accountant doesn't comprehend your data, they can feel uninformed about the nuances of the procedure and thus far from the project's progress. This is your chance to explain what you perform to the client in a way that will increase their trust and confidence in the procedure. Your client will feel competent and informed if you explain what you did, why you did it, and how you arrived at your decision.

Know Your Client's Objectives

You must comprehend your client on both a micro and global level if you want to be successful. You should be aware of the project's aims and objectives at the micro level. On a larger scale, though, you should comprehend how this project fits into the organisation as a whole and any significant information about the client's culture that could be useful to you in your involvement. Understanding your client's objectives will enable you to establish a connection based on mutual respect and trust.

Use tools for project delivery

Making a good first impression on clients requires organisation in project delivery. Use resources like a project proposal, contract, SOW, client reports, and a professional invoice to ensure that your work is completed professionally. These tools can help you become more professional and improve your business abilities while also allowing you to track and provide transparency for your project.

Determine what would be valuable to your client by keeping them in mind. It could be as easy as hand-delivering the materials and providing a thorough walkthrough or demonstration, delivering the project in an aesthetically beautiful format, or including a modest value-adding feature that improves the final results. After significant company milestones or over the holidays, giving devoted customers a gesture of appreciation and gratitude can be a pleasant surprise that improves your professional connection. Finding the chance to go above and beyond in a way that your clients will value is the key.

Appreciate the efforts.

Setting boundaries with your clients is crucial, but there are occasions when going above and above can benefit your company. Maintain boundaries, but watch for opportunities to go above and beyond.

It can be simple to fall into old patterns if you've been in the industry for a while. Instead, give each client issue particular thought, and don't be scared to change how you do things at work. Others may simply like a written, thorough weekly report of what you've completed, while some clients may genuinely value hands-on access and want to be involved in each stage of your process.

What are the terms of payment?

Documentation that specifies how and when people will pay for your goods or services is known as a term of payment, or payment term. The terms of payment specify how and when clients must make payments as well as any potential consequences for late payments.

Be specific with your terms and conditions.

Typical invoice payment periods include the following:

A date of the bill.

The full amount owed on the invoice.

The deadline by which your client must pay the entire amount due, as well as the payment date.

Conditions for a deposit or advance.

Information about the payment schedule.

An inventory of acceptable payment options.

How is a contract modification added?

The modifications to the original contract might be listed in a letter that both parties must sign. A contract amendment can be generated using a template or from a provider of legal services. The original signed contract can have addendum pages at the end of it, either digitally or printed.

Use Awesome Sign to get started, and sign your pdf documents effortlessly.

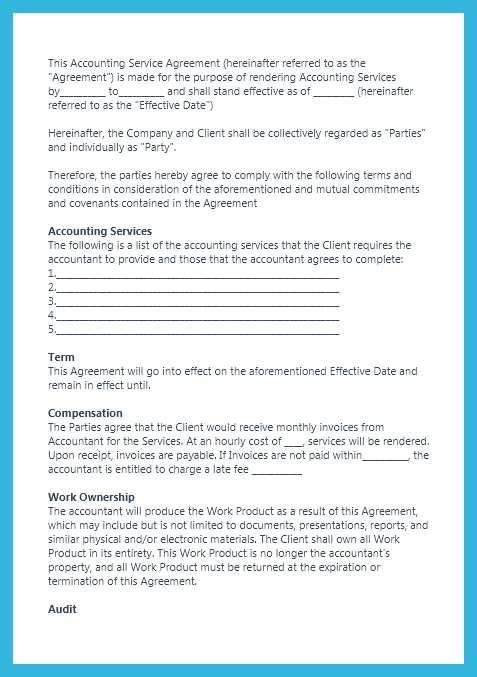

Template Preview

Accounting Contract

effective as of ______________ (hereinafter referred to as the "Effective Date")

Hereinafter, the Company and Client shall be collectively regarded as "Parties" and individually as "Party".

Therefore, the parties hereby agree to comply with the following terms and conditions in consideration of the aforementioned and mutual commitments and covenants contained in the Agreement

Accounting Services

The following is a list of the accounting services that the Client requires the accountant to provide and those that the accountant agrees to complete:

1._______________________________________________________________________________

2._______________________________________________________________________________

3._______________________________________________________________________________

4._______________________________________________________________________________

5._______________________________________________________________________________

Term

This Agreement will go into effect on the aforementioned Effective Date and remain in effect until.

Compensation

The Parties agree that the Client would receive monthly invoices from Accountant for the Services. At an hourly cost of ______ , services will be rendered. Upon receipt, invoices are payable. If Invoices are not paid within______________ , the accountant is entitled to charge a late fee _______________

Work Ownership

The accountant will produce the Work Product as a result of this Agreement, which may include but is not limited to documents, presentations, reports, and similar physical and/or electronic materials. The Client shall own all Work Product in its entirety. This Work Product is no longer the accountant’s property, and all Work Product must be returned at the expiration or termination of this Agreement.

Audit

The accountant will keep thorough records of all transactions made in connection with the Services and this Contract. For the time frame allowed by law, the Client and governmental organizations will have full access to the accountant’s records for inspection and audit.

Limitation Of Liability

Except as specifically stipulated in this Agreement, the Distributor shall have no obligation to reimburse the Company for any claim brought by the latter pursuant to this Agreement. Except in cases of gross negligence, bad faith, or wilful misconduct determined by a court of competent jurisdiction, the Agent shall not be liable or responsible for any action performed or omitted by him in accordance with this Agreement in good faith.

Representation And Warranties

The Parties acknowledge and agree that they have full authority to enter into this Agreement. Representations and Warranties The actions and duties of both Parties must not impact upon the rights of any third party or, if applicable, contravene any other agreements between them and/or with any other group, individual, company, or governmental body.

Confidentiality

The Parties are aware that they are exposed to the disclosure of information or documentation, whether written or oral, that is confidential or otherwise unreleased. Therefore, by adopting this provision, the Parties undertake to keep all secret information acquired throughout the course of the Agreement private, both during and after its execution, without the other Party's prior written agreement.

Termination

A written notice to the other party from either client may end the accounting services at any time. And they are also responsible for the payment of all the services performed up to the date of termination. All parties' and clients' materials, content, and work products must be returned by the accountant.

Disclaimer of Warranties

The Employer therefore guarantees that the Services contracted for in this Agreement will be completed in accordance with the User's needs and specifications. However, the Employer does not guarantee or suggest that the services offered under this Agreement will increase sales, brand recognition, exposure, profits, or anything else. In addition to the

foregoing, the Contractor has no obligation to the Client should the outcomes of the work supplied fall short of what the Client had anticipated for.

Governing Law and Jurisdiction

The Parties agree that this Agreement shall be governed by the State and/or Country in which both Parties do business. In the event that the Parties do business in different States and/or Countries, this Agreement shall be governed by __________________________ law.

Indemnity

By signing this agreement, the Company promises to hold the Client harmless from any losses, expenses, and legal fees that the Client may incur as a direct result of the Company's actions or inactions. The Client hereby agrees to hold the Company harmless from any losses and damages brought on by any of the Client's acts or omissions.

Entirety

The parties agree that this contract enumerates and summarises their whole understanding. Any terms that the parties agree to alter, add, or change must be put in writing and signed by both parties.

Dispute Resolution

All or any disputes arising out of, relating to, or involving the terms and conditions of this Agreement, including the interpretation and applicability of its terms and the rights and obligations of the Parties, shall be resolved amicably through mutual discussion; if this is not possible, the disputes shall be resolved through the adjudicating officer designated under the Act.

Entire Agreement

When entering into new contracts as well as changing or restating old ones, parties must carefully decide whether to include an entire agreement clause. In conclusion, parties should make sure they are clear on what is included and excluded in the contract before it is executed.

Waiver

If either Party fails to exercise a right, power, or privilege granted by the terms of this Agreement, that failure will not be interpreted as a waiver of that right, power, or privilege or the exercise of any other rights, powers, or privileges in the future.

Legal costs

The prevailing party will be entitled to its legal fees, including but not limited to its lawyers' fees, in the event that a dispute results in legal action.

Amendments

The Parties acknowledge that this Agreement may be amended only in a document signed by both of the Parties hereto. Any modifications made by the Parties shall therefore be

incorporated into this Agreement.

Signature And Date

The Parties hereby agree to the terms and conditions set forth in this Agreement and such is demonstrated throughout by their signatures below:

Client

Name: _______________________

Signature: ___________________

Date: ________________________

Accountant

Name: _______________________

Signature: ___________________

Date: ________________________