Commission Agreement Template

A commission agreement form is a formal contract signed by two parties. The first party wishes to sell products or services. The goods or services will be marketed and sold by the second party. For each transaction, the first party pledges to pay the second party a specified amount of money, known as a commission. A commission agreement form should include the percentage of commission or cash amount for each sale, as well as when commissions will be paid out.

What is a Commission Agreement?

A written contract between two parties is referred to as a commission agreement form.

The first party wants to sell some goods or services. The other party will promote and market the products or services.

For each sale made, the first party agrees to pay the second party a specific sum of money, known as a commission. The commission agreement form can assist in defining the proportion of the sale that each business will retain and the amount that will ultimately be available to pay sales associates.

When recruiting new employees for the company, a commission agreement is a crucial instrument. Additionally, it is necessary if you are going into a sales position where you will be paid on commission. The amount of payment at the end of the month would ultimately depend on your sales. Establishing specific conditions for their agreement is advantageous for both the employer and the employee in order to prevent any misunderstandings.

If the employer decides to have a non-compete clause, now would be a good moment to include it.

You could use Awesome Sign's easy to use electronic signature to easily edit pdf template.

Organization of the Agreement

The characteristics of each industry will determine the commission agreement's structure. In terms of structure, a real estate commission agreement will be designed differently from a sales commission agreement.

This suggests that the agreement's structure needs to be carefully chosen. The format of these materials is not predetermined. The objective is to identify the factors that will encourage the agent while also helping the business.It is important to determine who the agreement is for when developing one since this enables appropriate language use and the inclusion of all relevant information.

For instance, hiring commission-based agents may be a function of the company.

Components of Commission Agreement

Contact information includes the representative's first and last names, the name of the organization, and the parties' addresses and phone numbers.

Authorization - Gives the salesperson permission to sell products or services on behalf of the employer.

This clause allows the salesperson permission to promote the goods or services of their employer.

The employer frequently imposes restrictions on the regions or countries in which the products may be sold and forbids the rebranding and resale of their goods.

Commission Structure: Describes the commission rate and other aspects of pay.

You provide the specifics of the commission structure here.

Both the employee and the employer should understand these things after reading this section:

- The scale of compensation (e.g., commission, performance incentives, bonuses)

- Any time a commission is received

- How often are commissions paid

Consequences of customer cancellations, refunds, or payment defaults

Documents – Tells a salesperson to conduct sales operations using forms and documentation that have been approved by the firm The salesperson must consent to keeping track of their sales efforts using records and methods that have been authorized by the company.

Resources like CRM databases, software, or forms may be among them.

Non-Compete Clause: Requires a salesman to swear off representing rival brands and businesses for a predetermined amount of time.

A non-compete agreement mandates the salesperson to refrain for a certain amount of time after leaving their job from representing or selling for a competitor.

Non-Disclosure Clause: Requires a representative to act in the employer's best interests at all times and to protect trade secrets, proprietary information, and confidential information.

The non-disclosure clause guarantees that the employee has agreed not to disclose proprietary information or confidential information.

Acceptance -By signing and dating the form, the salesperson and their employer confirm that they both agree to the terms of the sales commission agreement.

Consult your legal team or seek the counsel of a lawyer to assist you in properly drafting your sales commission agreement if you need any more suggestions or guidance.

Benefits of Commission Agreement

The commission is paid on each sale made under a marketing or sales agreement because they are repeated in nature.

You're planning to establish everyone's rights and obligations before recruiting a new worker who will be compensated entirely or in part on commission.

If your company hasn't given you a written Commission Agreement, you want to ensure that everyone's rights and obligations are spelled out before you start working there.

Encourages workers to put forth more effort

Highly skilled sales and marketing professionals benefit more from commission-based compensation because their remuneration is based on how hard they work.

In comparison to their less driven peers, they will receive a more generous reward the more sales they generate.

Aids in controlling payroll costs

Employers can control their payroll costs by paying staff members on a commission basis.

Employers can reduce expenditures, especially for underperforming staff, because the amount they pay their employees depends on the sales or money they produce.

It's also a terrific method to create a motivated and proactive workforce.

Commission Plan Types

Direct Commission Strategy Plan

There is no base wage in this plan; instead, sales representatives' income is derived entirely by the sales they generate.

This design often creates situations where high-performing sales representatives flourish, but the framework doesn't encourage stability.

Why Use It?

Startups and other companies without reliable access to funding frequently make use of this unique structure.

It resembles a pay-as-you-go system in many aspects, which frequently works for companies that lack the funds to offer competitive base salary.

Plan of Straight Commission

Salespeople are rewarded under a straight-line compensation structure regardless of how much or little they sell.

As the name suggests, it is based on a straight correlation, a pattern that frequently continues even after sales representatives reach their quota.

It's one of the better ways for companies to motivate underachievers to reach quotas without hindering overachievers.

Why Use It?

Organizations that wish to encourage salespeople to attain their maximum potential and have the means to support an unrestricted compensation structure do best with a straight-line commission plan.

Base Salary Plus Commission

Perhaps the most common commission arrangement is the base wage plus commission scheme.

Salespeople are given a base income and commission under this model.

The typical wage to commission ratio is 60:40, with 60% fixed and 40% variable.

Why Use It?

For businesses where the success of the sales organization depends on the retention of sales reps, this structure is suitable.

The business actively supports a particular rep's success while rewarding their performance.

Absolute Commission Plan

An absolute commission scheme compensates salespeople for achieving predetermined targets and carrying out particular tasks, including bringing in new clients.

Similar to the relative commission plan, an absolute commission structure can aid in motivating underperformers; however, the focus is more on action than revenue.

Why Use It?

This tactic is typically used to assist in focusing sales representatives' attention.

An absolute commission plan that is focused on a certain activity may be used by a corporation to boost its numbers for that activity.

Plan for Relative Commission

With a relative commission structure, a representative's commission is directly correlated to the percentage of a predetermined quota they hit.

Reps have a greater safety net thanks to this remuneration, which is added to a base income rather than a straight commission structure.

Why Use It?

In essence, this plan is a more secure alternative to a direct commission plan.

Although it doesn't alienate salespeople who may be having problems, it is still directly related to performance, which results in less turnover.

Commission on gross profit

In this type of commission, you are paid a percentage of the sale's gross profit.

Therefore, the greater the sale's profit margin, the greater the commission you will receive.

Sales revenue commission

You receive a predetermined proportion of each sale you make as a sales income commission.

Therefore, the commission check you will receive will be larger the more sales you generate during a pay period.

Placement fees

You will be paid a fixed amount for each sale.

If the placement fee is $10, for instance, you will receive $10 each time you make a sale, providing you with an incentive to sell as many units as you can.

Performance gates

You will receive a bigger commission share the more you sell.

There are frequently several income tiers, and your commission will rise each time you meet a predetermined number of sales or revenue goals.

There are numerous hybrid versions that combine aspects of all the above plans in addition to the ones already listed.

One must fully comprehend the commission structure that is a component of your compensation package if you want to succeed as a sales representative.

Before accepting a sales position, be aware of what is expected of you and how commission may affect your income.

The Commission Plan

Once commission is received. The agreement must specify in detail how and when the salesperson will get their commission. For instance, there may be a significant difference between crediting a sales agent with commissions when an order is booked and when the order is actually paid for, depending on the specifics of the sale.

Dates on which commissions are due. Additionally, the agreement should specify when commissions are to be paid as well as the date that the sum of each payment is determined. The agreement might specify, for instance, that commission payments must be made on the 15th of each month and that they must include all commissions received as of the previous month's seventh.

Your commission structure - Regardless of whether your sales representative receives a salary plus commissions or is covered by a commission-only compensation plan, your agreement needs to include a thorough explanation of every facet of your commission structure. The specifics should outline not only the compensation your representative will receive for each transaction they close but also the formula applied to determine the sales volume needed to calculate that commission. For instance, it should be made very clear in your agreement if the commission is to be paid on sales less any applicable taxes or shipping fees.

Performance rewards- Many companies provide incentives to their sales representatives to encourage them to make more sales, such as bonuses for attaining a certain volume of sales or a tiered commission structure.

The effects of cancellations, refunds, or payment delays. Every sale a company makes should be the final one in an ideal world. However, as all owners of small businesses are aware, a variety of things might take place to prevent a sale from occurring. Your agreement needs to take into consideration all possible scenarios and their potential effects on commissions, including product returns for a refund, order cancellations, and customers who fall behind on payments.

Termination of a Commission Agreement

A commission agreement typically expires after the commissioned task is finished. If a fixed-term agreement was made, it expires when that time period has passed. Additionally, commission agreements may be declared to continue in effect until further notice.

In this situation, a notification to terminate the agreement may be given after the notice time has passed. The agreement will end when a reasonable amount of time has passed from the notice if no notice period was stated.

Trust between the parties is crucial because of the nature of a commission arrangement. Therefore, the fiduciary relationship (a connection founded on trust) must not prevent any party from terminating a commission agreement.

Among other things, attorneys at law are an exception to this rule. They are unable to abdicate their responsibilities until it is necessary to do so because of a conflict of interest or another significant circumstance.

Even in that case, the withdrawal must be performed without harming the primary. If the commission agreement doesn't contain any clauses allowing termination, doing so without legally sufficient grounds may make you liable for damages. An agent may be excused from their duties due to military duty, illness, or another legitimate reason like parental leave.

The agent must inform the principal of his or her decision to stop working on the commissioned activities early enough for the principal to appoint a replacement agent.

Use Awesome Sign to get started, and sign your pdf documents effortlessly.

Sales Cmmission Agreement Template

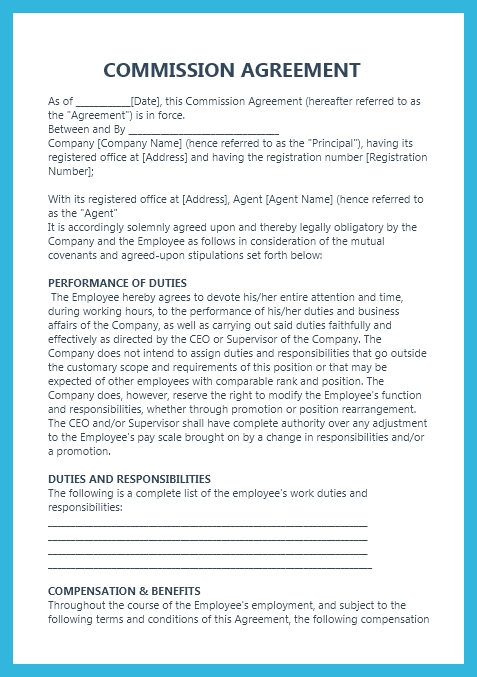

Template Preview

COMMISSION AGREEMENT

As of ____________[Date], this Commission Agreement (hereafter referred to as the "Agreement") is in force.

Between and By _________________________________

Company [Company Name] (hence referred to as the "Principal"), having its registered office at

[Address] and having the registration number [Registration Number];

With its registered office at [Address], Agent [Agent Name] (hence referred to as the "Agent"

It is accordingly solemnly agreed upon and thereby legally obligatory by the Company and the Employee as follows in consideration of the mutual covenants and agreed-upon stipulations set forth below:

PERFORMANCE OF DUTIES

The Employee hereby agrees to devote his/her entire attention and time, during working hours, to the performance of his/her duties and business affairs of the Company, as well as carrying out said duties faithfully and effectively as directed by the CEO or Supervisor of the Company.

The Company does not intend to assign duties and responsibilities that go outside the customary scope and requirements of this position or that may be expected of other employees with comparable rank and position.

The Company does, however, reserve the right to modify the Employee's function and responsibilities, whether through promotion or position rearrangement.

The CEO and/or Supervisor shall have complete authority over any adjustment to the Employee's pay scale brought on by a change in responsibilities and/or a promotion.

DUTIES AND RESPONSIBILITIES

The following is a complete list of the employee's work duties and responsibilities:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

COMPENSATION & BENEFITS

Throughout the course of the Employee's employment, and subject to the following terms and conditions of this Agreement, the following compensation will be paid to the Employee:

Employee will earn a base salary of per year, payable by direct deposit, with annual reviews and/or rate increases as judged appropriate; the amount of the basic salary will be decided by the CEO or Employee's supervisor.

Paychecks are given out as follows during the work week, which runs from Monday through Friday:

I Weekly paycheck is issued every time the pay period for that weekend; (ii) a Bi-Weekly paycheck is issued every time the two-week pay period ends; or (iii) a Bi-Monthly paycheck is issued at the end of every month.

(iv) A paycheck is sent every month.

(d) With sufficient written notice and after the end of their employment, employees are entitled to one week of paid vacation time, which is equal to one ordinary 40-hour pay period.

(e) The employee will be eligible for additional perks and privileges that are available to employees with comparable positions and ranks.

Payouts for commissions

The Employer shall pay the Employee a percent commission on the dollar for each new sales income that the Employee generates in addition to the annual base wage described in the preceding paragraph.

The revenue commission will be paid to the employee on a monthly basis and will only be recognized when goods and/or services are delivered to the customer.

Once a final determination of the "earned" commission has been confirmed, the employee will be paid the following month in which the commission was earned.

b) Commission payments are made to the employee on the first of every month.

b) For each commission payment given to the Employee, the Employer shall give the Employee a documented computation.

The Executive of Revenue will decide how much commission is paid on any additional sales.

The commission payments will keep coming in as long as the Company keeps doing business with the client and as long as the Employee keeps working there.

To continue receiving commissions, the Employee must continue to contribute to the development and management of the client base.

Payments will stop at that point if this agreement is terminated or if the employee dies.

However, if the employee is entitled to additional payments for periods or partial periods that may have occurred before the date of termination or death and for which the Employee has not yet been paid, as well as for any commission that may have been earned in accordance with the Employer's customary policy and procedures, then those payments to the Employee shall be made in accordance with company policy.

Qualifications for Bonus and Commission Payments:

The Employee must remain employed with the Company in the capacity for which s/he was hired.

Transfer and/or resignation will cancel the commission agreement and the Employee shall then become ineligible to receive any commissions as of the date of transfer and/or resignation.

Without a signed contract, no goods or services shall be provided, and no commissions shall be paid other than on goods or services actually provided.

The Employee is in charge of making sure that the Company has a signed contract on file for each client they acquire.

To keep his or her job with the company, the Employee must always perform satisfactorily.

This includes, but is not limited to, hitting predetermined quotas, providing excellent customer service, and taking responsibility for the efficient internal business procedures of the company that serves the clientele.

Employees who are paid through a commission scheme are not permitted to take part in the company's profit-sharing program if there is one.

This Employee Commission Agreement and Company compensation program may be altered in any given year based upon the Company's current business objectives and financial performance

UNAUTHORIZED DISCLOSURE OF CONFIDENTIAL INFORMATION

Any documentation, information, or knowledge regarding the operation or business of the Company or any of its subsidiaries or affiliates that the Employee has obtained or been made available to him/her during the course of their employment with the company, subsidiaries, or affiliates may not at any time be disclosed, released, or removed for his/her use or that of any

other person or business, whether during the Employment Period or after.

CONTRACTUAL RIGHTS WAIVER

Any failure by either party to enforce any aspect of this Agreement shall not be regarded as a waiver or restriction on that party's right to later enforce and require strict adherence to all of the Agreement's provisions.

ARRANGEMENT MODIFICATION AND/OR TERMINATION

This Consent may only be amended or terminated by mutually written agreement of the parties, with notice provided when practical (the Company and Employee).

Any "Amendment" to the original Employment Contract must be made in writing, and both parties must agree to it.

The "Amendment" must also provide a start date and end date for the original Employment Contract.

SEVERABILITY

Should any provision of this Agreement be found to be invalid or unenforceable, in whole or in

part, only that specific provision or portion of this Agreement will be affected; the remainder of

the provision in question and all other provisions of this Agreement will continue to be valid

and enforceable.

SIGNATURE

IN WITNESS THEREOF, the Agent and the Principal respectively have hereby set their hands on

the day and year first above mentioned.

COMPANY___________

SIGNATURE______________

AGENT________________

SIGNATURE__________________